{This is a sponsored post in collaboration with MassMutual and Latina Mom Bloggers.}

Who taught you how to manage your finances? ¿Quien de enseno sobre de las finanzas? Was it your parents or family? Or were you like me and kinda learned it along the way? It wasn't and hasn't been an easy road teaching myself about money management. My first lesson came from mi gerente (my boss) at my first job. Then later, I learned some hard lessons by making major mistakes. ¡Ay Dios! Because I've worked since I was 16, there were 'advisors' along the way who would come in at show me a thing or two in investing into a 401k or the likes of that but none who really stuck around or followed up. Not until I got married to a banker, did I begin to really understand the importance of planning and saving.

I read the findings from MassMutual about today's Hispanic families and the American dream. One piece about the findings I already knew was that Hispanics will always be in pursuit of the American dream. We just don't give up. Yet, Hispanics are vulnerable to potential financial setbacks and according to MassMutual, over one-third (35 percent) have set aside less than three months of their monthly living expenses for emergencies; 7 percent have no savings at all. ¿Qué paso, gente? Money doesn't buy everything but it gives us options, no?

Along with the American dream comes owning a home. According to MassMutual, paying off their mortgage is the top priority for Hispanic families followed by paying off credit card debt. This puts a child's future education savings on low priority. Only 31 percent of Hispanics rank saving for their children's education as a top priority while almost half say this it is important.* THIS is where I'm concerned the most. Education is key to a successful future as well as a thriving economy. With the Hispanic population continuing to grow, it is important for our country's economy for the next generation of Hispanics to receive a college degree or higher education.

So, how do we ensure that Hispanic families plan and save so that their children will be able to afford an education beyond high school? There are other factors to putting money in the savings account. For example, if there is enough money for school but parents or grandparents retire without a retirement fund, Hispanic families tend to lean on the younger generation to care for the elder. It's just they way familia is and Hispanics tend to put familia first.

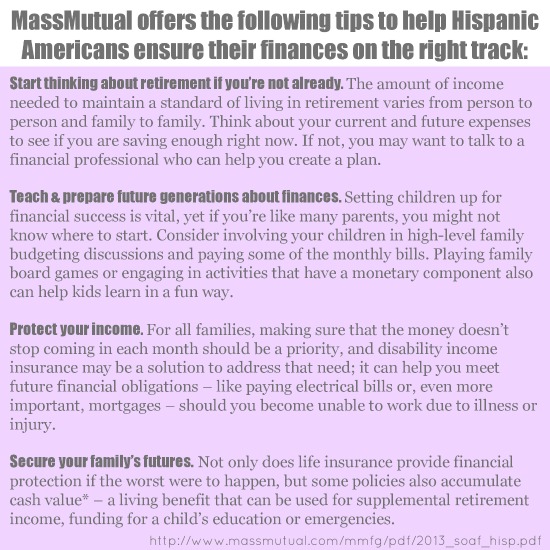

If your parents/family have already taught you how to successfully plan, save and manage your money for emergencies, retirement and education costs, congratulations and keep passing on that information to your family. If you haven't been taught or guided, MassMutual has some tips below. Plus, I encourage you to meet with a financial advisor. Start with visiting massmutual.com today to find a MassMutual financial professional in your area. Learn how to take the next step in creating a solid financial strategy and helping to achieve fiscal fitness. (En español: www.massmutual.com/espanol)

[Tweet “Let’s get our finances on track, gente, for us and our familia. #HispanicDream”]